While the cost-of-living crisis shows no sign of abating in the short-term, both consumers and businesses alike continue to face ongoing challenges of higher prices. A common issue that both face is that people are finding it harder to afford the same things they used to. With consumers spending more on just surviving, how can brands stay present and positive in the consumer’s mind during this time? How can brands navigate the challenges of maintaining brand salience and trust to ensure that they can be one of the essential commercial presences that consumers will depend on?

In this piece, I look at some recent research that we conducted with our Open Ideas panel in June 2023 to get a brief understanding of their current thoughts on the cost-of-living crisis. As part of this quick survey, we also asked members their thoughts on the role that businesses should take in communicating price rises to consumers, as well as how much trust they place in businesses to do this clearly and honestly. By better understanding consumer experiences and concerns about the current cost of living can help brands focus on building better consumer relationships and trust in their brand during a difficult time for all.

| Tweet This | |

| The cost of living crisis shows no sign of abating, and so both business and consumer must learn to navigate it in order to survive - that can only happen through data and insights. |

Understand Current Consumer Concerns

The overarching narrative consumers expressed in this bit of research was that their concerns about the current cost of living are unlikely to change in the short-term.

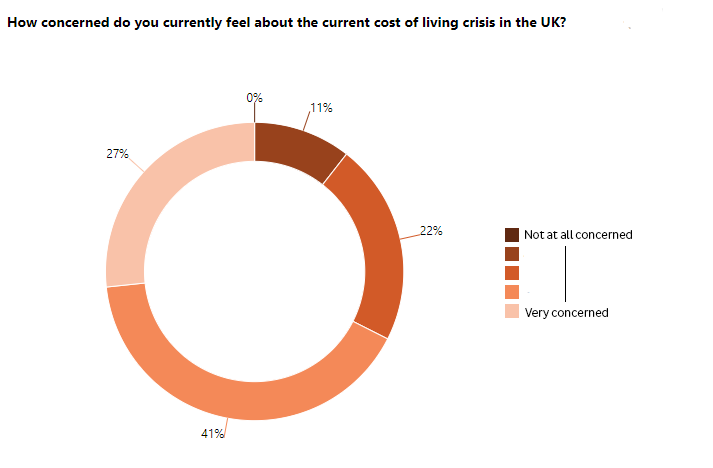

Our research with the Open Ideas panel showed that a majority of respondents express some level of concern about the current cost-of-living crisis as evidenced by the graph below. In addition to a majority raising concerns about the crisis, two-thirds of respondents noted having felt that the crisis has had a negative impact on their general financial situation.

Concerns that this may continue in the next six months showed very similar results, highlighting consumer concerns that the cost-of-living crisis is going to continue to have an impact on their financial health and wellbeing throughout the rest of this year at least.

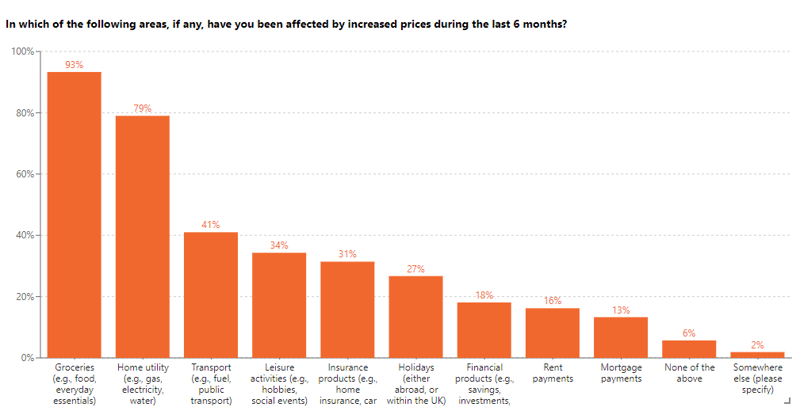

As we can see from the next graph below, consumers identified having seen the crisis have the most impact on the cost of their groceries, as well as higher home utility prices. Looking ahead to the next six months, pressures in these particular areas are expected to continue.

In addition, compared to older generations, those aged 25-44 are more likely to be concerned that they will be negatively affected by increases in rent and mortgage payments in the next six months. Nevertheless, expectations of being negatively impacted by the cost-of-living crisis in the near future are generally high regardless of age.

Trust, Communication and Honest Explanations

So, consumers are concerned about the current cost-of-living, but what role do they expect businesses to play in explaining price rises to them? And key to this, do they trust what businesses are telling them about the crisis?

Our research showed that most consumers feel that they have some degree of understanding the reasons for the cost-of-living crisis, with 1 in 5 feeling that they have a “very high understanding” of reasons for the crisis. When asked what sources of information they use to make sense of current challenges, a majority noted that they rely on news websites to understand the reasons behind current price rises. Only 23% of respondents said that they use company statements and press releases to inform their understanding, highlighting a gulf between the direct role and influence that businesses have in shaping consumer understanding compared to news sources.

There is a significantly low percentage of consumers who trust that businesses will communicate honestly about any reasons behind their price rises. Nevertheless, over half of respondents said that they expect businesses to provide clear and honest explanations of any price rises, with people aged 25-44 more likely to expect this than older generations.

Whilst this demonstrates that there is an appetite for brands to communicate with their customer base, trust in businesses to provider clear and honest explanations is generally quite low. Consumers appear to have lower trust in some industries more than others, with two-thirds distrusting energy providers to communicate clearly and honestly, and about half distrusting supermarkets and insurance providers to do likewise.

Building Brand Trust

Ultimately, understanding consumers can help brands of all shapes and sizes navigate the cost-of-living crisis’s erosion of brand trust – as well as encourage consumer interaction with brands beyond the simple traditional transactional relationship.

Brands face a challenge of simultaneously being expected to communicate the reasons for any price rises, though at the same time lack consumer trust that brands will do so with clarity and honesty. This is where effective research that centres the consumer experience across multiple channels and stakeholders within a business is key to generating insights that can unlock a brand’s potential to maintain or restore brand salience and trust. Understanding consumers’ specific fears and concerns and the ways that they would like to see brands supporting and communicating with them as the cost-of-living crisis continues will help brands to identify why trust in particular industries is low and what they can do to build it back.

Similarly, since consumers are currently more likely to get their understanding of price rises from other sources, exploring how to use these channels most effectively to contribute to educating consumers can help mitigate brand-damaging sources of misinformation and misunderstanding. Brands that build those effective communication channels with consumers can help deliver on the particular reassurances that their customers are looking for. And this is not only true for the aforementioned energy providers and supermarkets who currently face low levels of trust – other industries need to keep ahead of the crisis, with escalating concerns over rising mortgage prices risking mortgage and financial service providers seeing the same erosions of trust across the next six months.

Thus, engaging in such research focused on understanding the detail of consumer experiences and concerns during this period of price rises will help businesses stay focused on building trust in their brand and ensure both consumers and brands alike survive the current cost-of-living crisis.