When I sat down to plan this blog, I immediately thought: what aspect of market research do I not think about enough?

As Head of Development & Research at FlexMR, I don’t design as much research as I used to before I moved further into management; but my background before market research was in academic and charity research. One of the key considerations for my former research life was ‘What is the impact of my research on the individuals or communities that I am researching/addressing?’ When putting together a plan for research tasks such as interviews with marginalised communities or people who had recently experienced some form of loss or distress, it’s vital to consider whether you are effectively communicating the content and value of the research to the participants.

That isn’t to say that this is less important for market research; however, when you’re asking participants what colour and design they think would work best for a mailer, or what time of day they’re most likely to use a product, it’s easy to pull a dominant focus towards just question design or even project timeline, rather than ensuring the participant is a partner rather than simply a subject.

Another key difference in market research is the idea of saturation and cynicism – how many times has this consumer audience been asked about colour and design choices? Are they taking time and picturing themselves using a product in situ, or are they telling you which looks best in isolation on their PC screen? And do they think their response will even make a difference?

Participant experience is a key topic for insight experts and worthy of further digging, so I decided to do a quick experiment. I created a survey with the following objectives:

- Find out what a group of respondents think market research is and does

- Ask how often they feel they encounter market research, and if they trust it

- Discover how respondents interpret the purpose of a couple of question types

And then, because I’m out of practice, Nikki (one of our excellent Research Executives) designed the survey. 100 respondents from our Open Ideas community responded to this survey.

This is one of our longer articles, so if you’re looking for something specific then you can use the quick navigation links below to jump to each section of the guide:

- What do consumers think market research is?

- Why do we do market research?

- How often do consumers encounter market research?

- Do consumers trust market research?

- How do consumers interpret question types?

- Understanding the Participant Experience

What is market research, and what does it do?

First, we asked respondents, ‘What do you think Market Research is?’ The below word cloud is generated from verbatim text responses.

There were some excellent answers here – for example:

“To give a personal opinion on something a company wants to know, which they then collect and draw conclusions from/getting new ideas.”

“Asking the public what their perceptions are about a particular product, person or institution.”

“Studying the market to watch out for current and changing trends in what people buy and do in various situations.”

There was a refreshing amount of positivity in these responses:

“Asking questions to discover whether or not a product or service is living up to expectations, and to find ways to make improvements.”

“It is important for people to have a say”

And, of course, for some reason, there are always respondents willing to take some time out of their busy days to troll a survey:

“Getting onions.”

Overall, just over 70% of respondents have a good or very good understanding of what market research is. As you can see from the word cloud, the most common responses revolved around opinions, people, products, and research.

| Tweet This | |

| Just over 70% of respondents have a good understanding of what market research is - but many don’t particularly trust it. Where are we going wrong? |

We then asked, “Why do you think companies and organisations use Market Research?”

Responses here were just as educated, but slightly more fractious. While we, again, had some very positive responses:

“To make responsible choices”

“To improve things for the future”

“To improve their business”

Quite a few were more cynical about purpose and value:

“To get accurate information. I wonder how many do.”

“To assist with marketing”

Overall, about 75% of responses fall into the theme of ‘to sell products more effectively and make more money’. Fewer than 20% of responses mentioned removing bias, improving the life of consumers (separately from being profit-driven) or trying to make any wider policy or impact improvements.

For me, there’s a clear lesson here: consumers assume you’re asking for their feedback so someone can turn a profit. If the reasons behind your research are more elevated, you’ll need to preface this with effective participant education about purpose and scope.

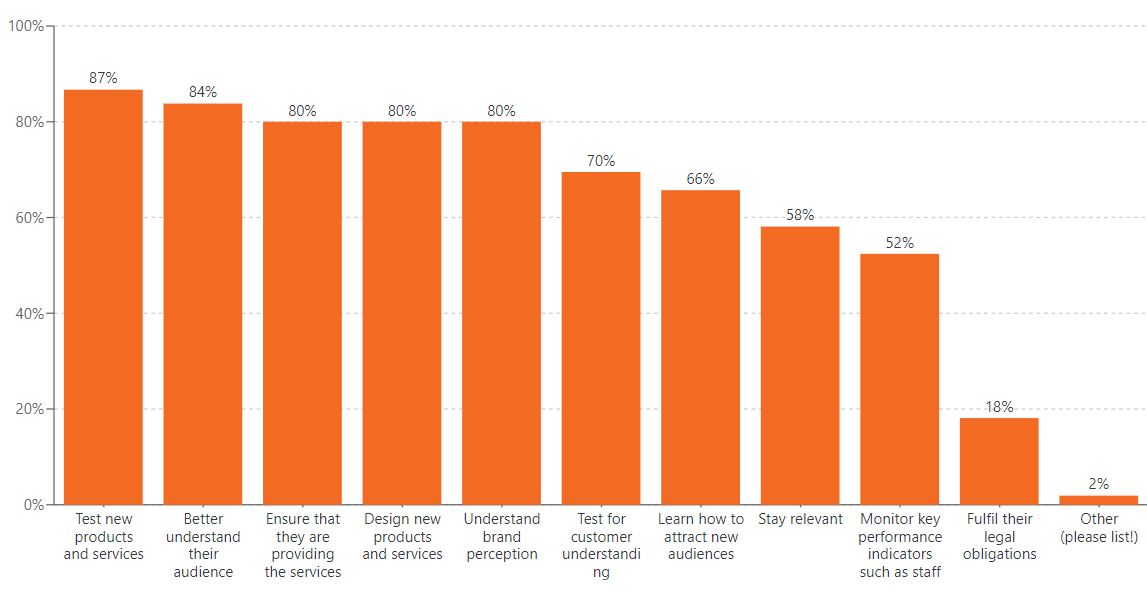

We then asked a multiple-choice question, asking respondents to select all that apply:

Market research is a way to…

This, again, shows good understanding from our respondents. That said, I’m surprised at the disconnect between the high scores for understanding the audience, ensuring service provision and understanding brand perception, and the much lower score for monitoring staff satisfaction and NPS scores. Given how widely NPS surveys are used as a tool, this begs the question: do respondents understand why they’re being asked NPS questions? And if they did, would their scores change?

How Often Do Consumers Encounter Market Research - and Do They Trust It?

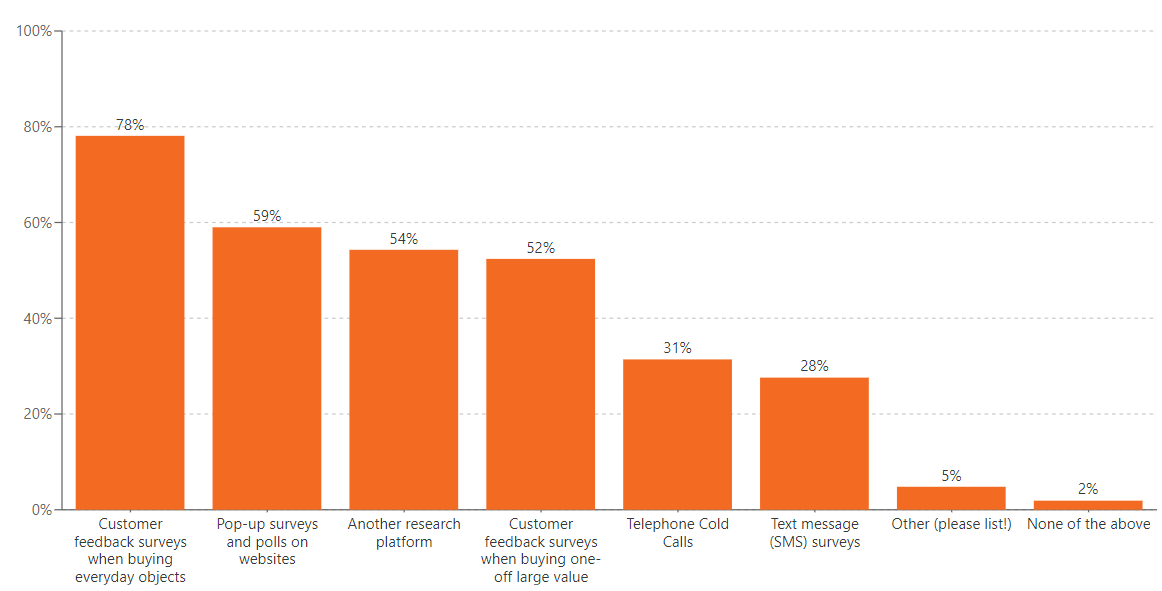

We first asked respondents where they encounter market research day-to-day:

Shout out to the less than 2% who aren’t encountering any market research, but are answering a market research study about market research. You beautiful enigmas.

An interesting finding here is how many of our respondents are also on other research platforms (more than half). This really does highlight the value of thorough data cleaning and rigorous screening/sourcing. Yes, you might be able to throw a survey out with a low-budget provider who tells you they can reach thousands of respondents for an unreasonably low price, but they really are too good to be true. If you’re not working with a provider who has rigorous quality checks in place, you’re paying for fake data and making your business decisions based on it.

| Tweet This | |

| If your respondents are participating on your research platform, chances are they're also on another - more than 50% of respondents are signed up for 1 or more research platforms. |

Do They Trust Market Research?

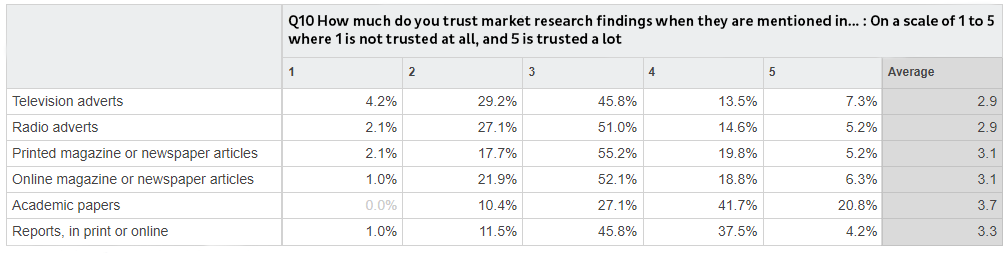

We turned our attention to the extent participants trust various sources of findings on a 1-5 scale (1 = not at all, 5 = a lot):

For me, these low scores are a concern. Respondents know what market research is for, and they encounter it regularly, but many don’t particularly trust it. Is this because they feel like findings are being reported incorrectly? Do they question the methodologies in place? Do they know that they’ve lied in surveys or focus groups before, so they think others must be doing so as well? I’ll be digging into this as part of research for my next blog – so keep an eye out for that.

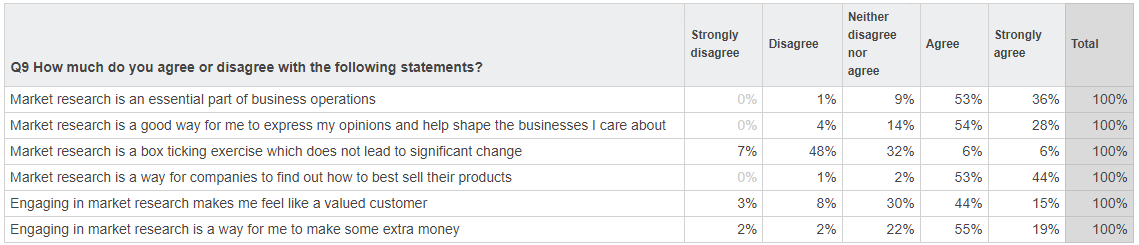

We then presented a set of statements about market research to our respondents to see whether they agreed or disagreed with them to get a deeper understanding of their specific views on market research:

It is a relief to see that very few felt that market research is a box-ticking exercise that does not lead to significant change and that most also feel that engaging in market research is a good way to express opinions and shape businesses.

However, there’s a much less encouraging bit of data here – less than 60% feel that market research makes them feel like a valued customer.

So: Respondents like to share opinions and shape businesses, but market research doesn’t make them feel valued.

This is something I’ll be bringing up with insight experts moving forward. Are we making respondents and participants feel like their opinions are valuable in our research? Is it clear to the participants that research can make a difference? If not, we need to work with both stakeholders and respondents to ensure that participating in market research can be seen as a positive part of a customer experience.

How Do Respondents Interpret the Purpose of Different Question Types?

Finally, we wanted to get an understanding of whether respondents understand the objectives or meaning behind questions. Research participants aren’t the researchers’ enemy – they’re not there to be tricked into giving answers they don’t mean to give. The further we obfuscate our objectives and methods, the less trust we have from respondents, and therefore the less engagement and honesty we can expect from them. I intend to do a full study on this in the future with two versions of the same survey, one with just the questions and one with the objectives added to each question so the respondent can see, to see how results and engagement differ. So, for now, this is just a two-question toe-dip.

First, we asked:

What information can be gained from asking this question in a survey? What objective would the clothing company asking this question have?

Q: When shopping for clothing, which of the following best describes you? Please select one.

1. I mostly buy only when needed (e.g. grown out of or worn out)

2. I mostly buy when I see something I like

3. I mostly buy for a set occasion (e.g. events or holidays)

4. I mostly buy when I see a sale or see clothing on discount

Then, because people automatically defaulted to answering the question about shopping, rather than the bolded question above, we added the line:

“^ Please answer the question above, rather than providing an answer to the question in italics!”

After the very quick edit to the live survey, almost all respondents correctly identified the purpose of this question (to better understand purchasing behaviours), although none mentioned that this would be cross-referenced with other questions to segment the respondents.

We followed this by asking:

What could we learn from the question below? What objective do you think the financial services company asking this question would have?

Q: Given the current financial markets, how concerned are you about your pension fund? Please can you give an answer between 1 and 5; where 1 is not concerned at all and 5 is very concerned.

This time, respondents were significantly less sure of the purpose. While about 50% gave good answers, many wrote that they were unsure or gave a partial response.

While this was just a quick toe-dip into a longer piece of research I am planning, it shows that once we ask about less common or more complex situations/ideas, respondents need context or description to understand the concept.

If we had just put this question out there for a response, 50% of respondents wouldn’t have been completely sure of what a researcher could learn from the question or what the objectives motivated the financial company to ask the question. As such, they would be less likely to feel value in responding, and therefore be more likely to give dishonest or incomplete responses.

Understanding the Participant Experience is the Key to Improving It

One of the key elements of my training as a researcher outside of market research was the importance of making sure the participant feels valued and informed. At the same time, one of the key building blocks to growing and maintaining a strong consumer base is ensuring that the consumer/customer feels valued and informed.

Market research is a crucial touchpoint between businesses and current or potential customers. The perception of these survey respondents was that market research is undertaken to turn a profit, they don’t trust that research serves to benefit them as customers, they don’t particularly trust the findings, and yet 89.6% feel that it is an essential part of business operations.

As market researchers, we have a duty to ensure that participants feel informed and valued when taking part in our research. If we are not doing so, we’re failing our clients and research participants.

Moving forward, I’m going to run further work to find out the full impact of better-informing survey respondents on the reasoning and objectives behind the questions they’re answering. The better we learn to make sure our respondents feel trusted and valued, the better they’ll engage with our research. The better engaged they are, the better and more reliable the insights. Market research should be about actionable insights that can inform successful CX and business strategies, and we’re kidding ourselves if we think this comes from running work where the participants don’t feel like their opinions are valued.

I encourage other researchers to run similar experiments with their own communities or panels. At best, you might find that you have a really informed and engaged group of respondents to draw on… a great thing to be able to tell a client. At worst, you may find your approach, or your community, in need of a refresh, and now you’ll have the insights to transform your approach and community into a truly impactful research experience, with a participant experience that makes them feel valued.